Recently, many people have demanded GST exemption on COVID vaccines while many are wondering why, at these testing times, have GST exemption already not been granted on COVID vaccines and medical supplies.

To a common man, the idea of GST exemption simply means reduction in price. To put this into perspective, suppose, if we are purchasing an item ‘A’ for ₹1,100 on which GST of ₹55 (Rate of GST: 5%) is applicable, the purchase price of item ‘A’ for the end consumer will be ₹1,155. So, if GST exemption is provided for item ‘A’, then would be purchase price for the end consumer be ₹1,100? Sadly, no.

The answer to this question is not as simple as we think.

Topics Covered

This article contains the following:

- Treatment of Input Tax Credit (ITC) attributable to supply of exempt goods or services

- Role of Anti-Profiteering measures under the Goods and Services Tax Act

- GST refund of unutilised input tax credit

- IGST on import of exempted goods

- Import Substitution Industrialization (ISI) Policy

- ITC on goods supplied free of cost

- How does an exemption from GST on a product make it expensive?

Analysis: Legal Aspect of GST Exemption

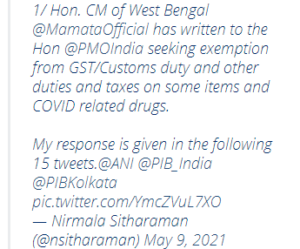

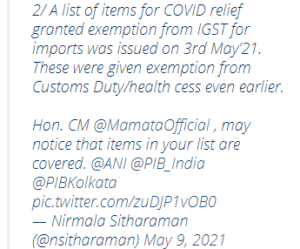

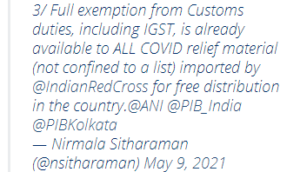

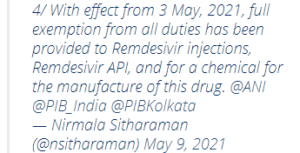

On Sunday, 9 of May, 2021, office of the Finance Minister Nirmala Sitharaman posted a series of tweets explaining why GST exemption should not be provided on COVID vaccines and medical supplies.

The tweets concluded that exemption to COVID vaccine from GST would be counterproductive without benefiting the consumer. Let us analyse the above reply with respect to the provisions of the Goods & Services Tax Act.

Apportionment of ITC u/s 17(2)

Sub-section 2 of section 17 of the CGST Act, 2017 deals with apportionment of input tax credit (ITC) when outward supplies include exempt supplies as under:

Where the goods or services or both are used by the registered person partly for effecting taxable supplies including zero-rated supplies under this Act or under the Integrated Goods and Services Tax Act and partly for effecting exempt supplies under the said Acts, the amount of credit shall be restricted to so much of the input tax as is attributable to the said taxable supplies including zero-rated supplies.

From, the above paragraph, it is certain that the ITC availed on inward supplies shall be restricted only to portion attributable to taxable outward supplies including zero rated supplies.

Hence, for the vaccines produced in India, if exemption from GST is provided, ITC will not be available on the cost of production of such vaccines. Hence, the GST on the cost of production including overheads such as packaging, storage, transportation etc. on these vaccines shall form part of cost of production, resulting into increase in production cost. Hence, this cost will ultimately be passed on the end consumer if exemption from GST is provided.

What happens to the unutilized ITC of the domestic producers?

Since, GST on COVID vaccines is applicable at 5%, it is likely that ITC availed on the cost of production at various higher rates is not completely utilized by the GST paid on the outward supplies.

So, why would the unutilized ITC not form part of cost of production?

Subsection 1 of Section 171 of the CGST Act, 2017 prescribes anti-profiteering measures whereby, the benefit of input tax credit shall be passed on to the recipient as under:

Any reduction in rate of tax on any supply of goods or services or the benefit of input tax credit shall be passed on to the recipient by way of commensurate reduction in prices.

Sub-section 3 of section 54 enables a registered person to claim refund on unutilized ITC where the credit has accumulated on account of rate of tax on inputs being higher than the rate on outward supplies as under:

Subject to the provisions of sub-section (10), a registered person may claim refund of any unutilised input tax credit at the end of any tax period:

Provided that no refund of unutilised input tax credit shall be allowed in cases other than—

| (i) | zero-rated supplies made without payment of tax; |

| (ii) | where the credit has accumulated on account of rate of tax on inputs being higher than the rate of tax on output supplies (other than nil rated or fully exempt supplies), except supplies of goods or services or both as may be notified by the Government on the recommendations of the Council: |

Provided further that no refund of unutilised input tax credit shall be allowed in cases where the goods exported out of India are subjected to export duty:

Provided also that no refund of input tax credit shall be allowed, if the supplier of goods or services or both avails of drawback in respect of central tax or claims refund of the integrated tax paid on such supplies.

Hence, the domestic producers can claim refund of unutilized ITC as per the prescibed provisions.

Due to the prescribed anti-profiteering measures and availability of refund on unutilized ITC, unutilized GST shall not form part of cost of production.

What about Imported Vaccines?

If GST exemption is provided on COVID vaccines, IGST on import of vaccines will not be applicable. So, this will result into reduction of cost of imported vaccines for the end consumer.

However, this goes against India’s policy of encouraging local/homegrown industries. This is called import substitution industrialization (ISI), a trade policy that is about substituting imports with domestic manufacturing and production.

Legal Implication of Vaccines supplied Free of Cost

However, for the vaccines supplies free-of-cost, it is altogether a different story. Clause ‘h’ of sub-section 5 of section 17 of the CGST Act, 2017 restricts ITC on goods supplied free of cost.

Hence, the suppliers who are distributing the vaccines free-of-cost bear the GST of cost of production/procurement, as if, they are the end consumer.

Does GST Exemption on Goods always make them expensive?

Citing our discussed example of item ‘A’, let us add few more details.

Let’s assume the profit markup on cost is 10% and the cost of production of item ‘A’ as under:

| Cost of Production of item ‘A’ | ||||

| Elements | Taxable Value(₹) | GST(%) | GST(₹) | Invoice Value(₹) |

| Item ‘X’ | 300 | 5% | 15 | 315 |

| Item ‘Y’ | 200 | 5% | 10 | 210 |

| Overheads ‘O1’ | 300 | 12% | 36 | 336 |

| Overheads ‘O2’ | 200 | 18% | 36 | 236 |

| Total | 1,000 | 97 | 1,097 | |

The taxable value of sale price of item ‘A’ is ₹1,100 and the profit is ₹100 (10% of cost price). Since the rate of GST on item ‘A’ is 5%, the final cost to the end consumer is ₹1,155 (₹1,100 + ₹55).

If, GST exemption is granted for item ‘A’, the ITC of ₹97 shall form part of cost of production. Hence, the cost to production will increase to ₹1,097 (₹1,000 + ₹97). Since the profit markup on cost is 10%, the sale price and final cost to end consumer of will become ₹1,206.70 (₹1,097 + 10%). Item ‘A’ will become expensive by ₹51.70 (₹1,206.70 – ₹1,155.00) for the end consumer.

However, the effective rate of GST on the cost of production in the above example is 9.70% (₹97 × 100 ÷ ₹1,000) which is higher than the rate of GST on outward supplies.

Let’s assume a scenario where the cost of production has substantive non – GST or exempt elements and the effective rate of GST on the cost of production is lower than the rate of GST on outward supplies, say 4%. Hence, GST on cost of production will be ₹40 (₹1,000 × 4 ÷ 100). If item ‘A’ is, now, granted GST exemption, the cost of production will increase to ₹1,040 (₹1,000 + ₹40). Since, the profit markup on cost is 10%, the sale price and final cost to end consumer will become ₹1,144 (₹1,040 + 10%). Item ‘A’ will become cheaper by ₹11 (₹1,155 – ₹1,144) for the end consumer.

Conclusion

In a nutshell, to assess whether granting exemption of GST on COVID vaccines is beneficial or not, one needs to calculate the effective rate of GST on the inputs attributable to its output supply.

If the effective rate of GST on inward supplies attributable to a certain product is higher than the rate of GST on that product, grant of exemption from GST will result into increase in price for the end consumer.

Likewise, if the effective rate of GST on inward supplies attributable to a certain product is lower than the rate of GST on that product, grant of exemption from GST will result into decrease in price for the end consumer.