Introduction

The GST council approved introduction of E-invoice System in a phased manner for business to business (B2B) invoices from 1st January, 2020 on voluntary basis. As of now, the mandatory requirement for E-invoicing for registered persons whose aggregate turnover in a financial year exceeds INR 100 crores shall now apply from 01st October, 2020 vide Notification No. 13/2020– Central Tax dated 23rd March, 2020. Also, the requirement for capturing dynamic QR code for registered persons whose aggregate turnover in a financial year exceeds INR 500 crores while making supplies to unregistered persons shall now apply from 01st October, 2020 vide Notification No. 14/2020– Central Tax dated 23rd March, 2020.

However, there are many confusions prevailing over this topic and many words have become simply jargons. I aim to simplify the understanding of e-invoice in layman terms. This will enable the readers to understand how the system works and what will happen if you choose to adopt it.

What is E-invoice?

There are many confusions/queries with respect to the operations of E-invoice System. Many are of the belief that E-invoicing will eliminate the use of their accounting softwares / ERP. Let us put all such notions to rest.

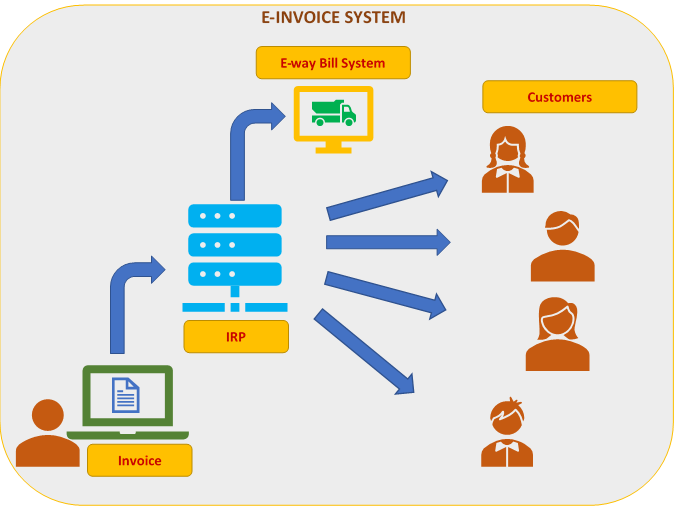

In simple terms, E-invoice means a standard set of fields which is uploaded on Invoice Registration Portal (IRP). The details which are available on a regular invoice will be uploaded to IRP. The process is very similar to data being uploaded for filing of GSTR 1.

However, there is a slight difference. In this system, a method has been introduced where an invoice is converted into a data with a common standard which can be read by anyone in the GST ecosystem.

The IRP will validate the data uploaded by the user and on successful validation, will generate a unique Invoice Registration Number (IRN) / Hash. The IRN will be generated by a hashing algorithm which will always remain unique for each invoice. Alternatively, the IRN can be generated by the accounting software/ERP using the hashing algorithm. The invoice will be digitally signed and a QR code for the same will be generated with the following parameters:

- GSTIN of the supplier

- GSTIN of the Recipient

- Invoice number as given by Supplier

- Date of invoice

- Invoice value

- Number of line items

- HSN code of the line item having highest taxable value

- Unique IRN / Hash

This will enable the invoice to be read by any handheld or other device with the functionality of reading QR codes.

What is IRN?

IRN is generated by the E-invoice system using a hash generation algorithm. For every document submitted on the E-invoice System, a unique 64 character IRN shall be generated. This will be unique for each invoice.

How does it impact the common user of the accounting software / ERP?

It does not at all. The invoices generated by you will remain same. The procedure would be performed by the accounting software / ERP probably in the background where the software will upload the details of the invoice to the IRP in scheduled batches.

World-wide implementation of E-invoicing (2018)

E-invoicing for B2B transactions is mandatory in the following countries:

- Belarus

- Brazil

- Chile

- Costa Rico

- Indonesia

- Mongolia

- Rwanda

- Turkey

- Ukraine

- Uruguay

Though E-invoicing is not mandatory but is allowed in the following countries:

- Albania

- Angola

- Australia

- Austria

- Belgium

- Botswana

- Bulgaria

- China (mainland)

- Croatia

- Curacao

- Cyprus

- Czech Republic

- Denmark

- El Salvador

- Estonia

- Finland

- France

- Germany

- Guam

- Hong Kong

- Iceland

- Ireland

- Isle of Man

- Israel

- Italy

- Kazakhstan

- Korea

- Latvia

- Lithuania

- Luxembourg

- Macedonia

- Malta

- Moldova

- Namibia

- Netherlands

- New Zealand

- Norway

- Pakistan

- Papua New Guinea

- Philippines

- Poland

- Portugal

- Romania

- Russia

- Senegal

- Serbia

- Singapore

- Slovakia

- Slovenia

- South Africa

- Spain

- Sri Lanka

- Sweden

- Switzerland

- Taiwan

- Uganda

- United Kingdom

- Vietnam

This signifies that India has decided to take a leap and be in line with global methodologies. However, we must understand that not many countries have made E-invoicing compulsory.

An implication can be drawn from this that challenges are also being faced by more developed countries than ours. Another drawn implication would be that the countries do not feel the need to do so. Whatsoever the case may be, we cannot ignore the benefits and challenges in adopting e-invoicing.

Why should we adopt E-invoicing?

- Since the outward supplies will be uploaded by the accounting software/ERP regularly and automatically, the time and effort of filing monthly / quarterly returns will be reduced considerably.

- Since the suppliers upload their invoices regularly, the reconciliation process will be seamless or near-seamless. The data of the suppliers can be downloaded by the accounting software/ERP as and when they are uploaded and the entries pertaining to the inward supplies can be entered automatically on the basis of certain pre-defined set of rules.

- One standard structure of the invoice will be followed throughout.

- Regular reconciliation will reduce the possibilities of fake invoices.

- E-invoicing will reduce printing of papers making it an eco-friendly measure.

- Near real-time availability of information will ensure better accounting.

- Automatic data will be transferred to the E-way bill system which will reduce time and effort.

- Manual errors will be reduced if data is uploaded automatically by the system.

Along with the benefits provided to users, this will also strengthen the detective controls adopted by the GST departments where they will be able to detect fraudsters on the basis of irregular patterns.

Challenges in implementing E-invoicing

India is still developing and technology is yet to reach the masses. There are many businessmen in the MSME sector who are still generating invoices manually using invoice books. They provide the copy of the invoices to their tax consultants or tax return preparers for filing GST returns. Not everyone is equipped with the requisite infrastructure.

The E-invoice system cannot function to its full strength until and unless all the tax payers become part of the system.

Additionally, many accounting softwares/ERPs do not follow the standard system development life cycle (SDLC) and are prone to bugs. If the system improperly integrated and the exceptions are poorly handled, there exists likelihood of information not being completely uploaded to IRP. This will compromise the availability aspect and can prove a hurdle in successful implementation.

The invoices might not be synchronized during downtime of IRP, if any. Though, duplication of invoices have been controlled by the use of IRN/hash, there always remains the possibility of invoices being skipped for upload due to any error or incorrect behaviour of the accounting software/ERP or the IRP.

Also, with every structural update by the IRP team, the users will be required to update their accounting softwares/ERPs in order to be in sync with the E-invoice system. The users will have to ensure that they receive constant support from the accounting software/ERP provider.

Are we ready?

The GST council has implemented E-way bill in a phased manner. Speaking about readiness, we will never be completely ready considering the dynamics of India. Radical decisions will have to be implemented in a structured, systematic and phased manner.

During any implementation phase, resistance is always felt. It will be very important for the GST council to implement it in a manner that does not excessively impact the dynamics of business in the country but also does not excessively delay the implementation.

It is very important for the taxpayers to welcome the benefits of the system with open hands despite facing hurdles during the implementation phase. Keeping long term benefit in mind, the taxpayers should prepare, update and change with the system.

The law is definitely moving very fast. It’s time for the people to keep up with the pace and move along.

However, I would also like to emphasize that along with the tax payers, the authorities should also be provided apt infrastructure in order to retrieve the necessary data on demand. This will ensure minimum interactions between the authorities and tax payers and will not create further hurdles in the process.

The Ideal World Scenario

Let us assume a scenario where everyone has adopted E-invoicing and it is being used on near real-time basis. This scenario will enable:

- Near real-time automatic verification of accounts between suppliers and customers.

- Issuing fake invoices will be reduced considerably.

- The origin of the accounts can be tracked along with the chain of invoices.

- The business can set pre-conditions where automatic entry of inward supply transactions can be triggered on meeting of certain conditions.

- The cost and efforts of compliance will be significantly reduced.

- The speed and efficiency will be increased significantly along with significant decrease in manual human errors.

Have suggestions or feedback? Let’s connect to discuss more!