The members of Gujarat Authority for Advance Ruling, Goods and Services Tax ruled that services such as stevedoring, transportation, storage, bagging, stuffing and again transportation…

Author: Ankit

Recently, many people have demanded GST exemption on COVID vaccines while many are wondering why, at these testing times, have GST exemption already not been…

The balance sheet is a preview of entity’s financial resources and commitments at a specific place of time and the statement of profit and loss…

The members of Gujarat Authority for Advance Ruling, Goods and Services Tax ruled that the applicant is liable to pay GST on reverse charge mechanism…

Work from home has now become a norm now. Sooner or later, everyone will have to accept it as a part of the new normal.…

A business, irrespective of its size, has multiple departments. Further, many businesses, startups and entrepreneurs find it challenging to manage their account departments and cope…

A lot of our clients have asked us doubts / queries pertaining to TCS u/s 206C(1H) which has been made effective from 1st October, 2020.…

Background Earlier, computers were merely used for storing records. But now, they have become a backbone of the decision-making process of a business. We know…

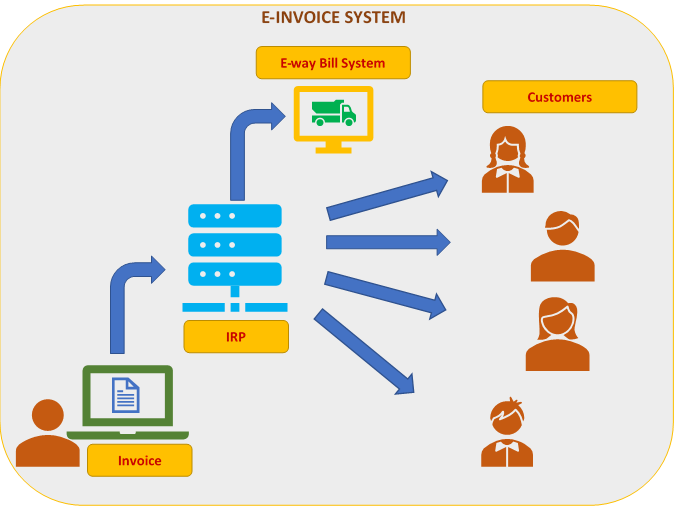

Introduction The GST council approved introduction of E-invoice System in a phased manner for business to business (B2B) invoices from 1st January, 2020 on voluntary…

To fight this COVID-19 situation, we all are in this together (but from a distance). Social distancing has proven to be the most effective measure.…